As we embark on a new year and a new decade, let’s take a moment to reflect on 2019 and look at what we might expect in 2020 . Is the stock market poised to tumble? Will fear over the China trade issue be a concern? What should investors do at this moment?

Before we look at 2019, here are a few facts on stocks using the Dow Jones Industrial Average.

Stock Market Facts

FACT: Stocks rise more often than they fall. In the 22,923 trading days from October 1, 1928 through January 6, 2020, stocks rose 52.26% of the days and declined 47.35%.

FACT: The average daily percentage gain was 0.723%. The average daily percentage loss was -0.746%.

FACT: When stocks fall, it’s usually because of a correction or a crisis. A correction can get ugly, but it is also a necessary event in any bull market. I do not find any evidence in support of a crisis on the near horizon. Now let’s look at 2019.

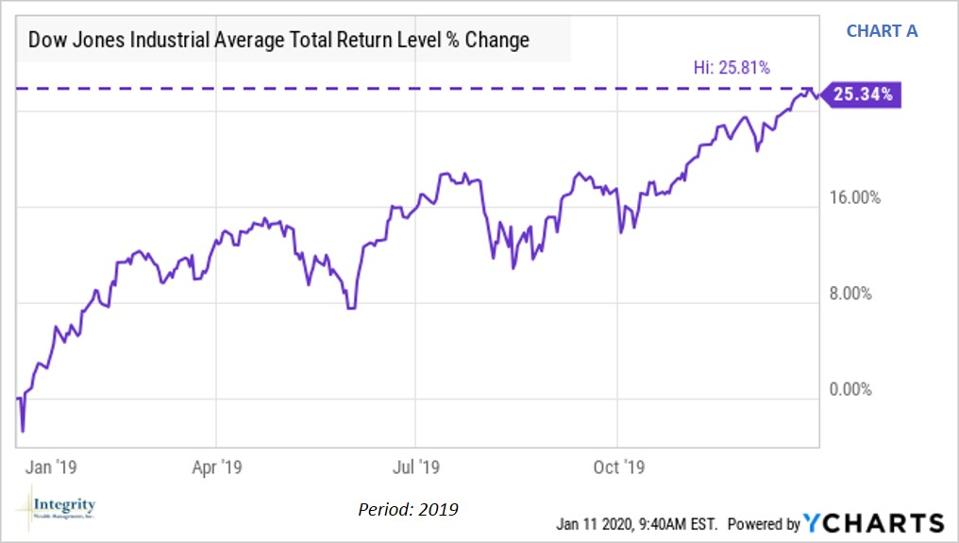

As the following chart shows, the Dow rose 25.34% in 2019. However, it did encounter a few bumps along the way.

2019 Year in Review-Chart A

The S&P 500 Index did even better, reaching 31.49% for the year (chart not shown). Why did the S&P outperform the Dow? There are two main reasons. The S&P contains more technology stocks (which did well in 2019) and it is a “cap-weighted” index. The Dow is not cap-weighted. To explain, assume all 500 (+/-) companies in the S&P 500 had an equal weighting in the index. If so, each stock would comprise approximately 0.02% of the total index. However, because it is cap-weighted, each company’s percentage of the index is based on its market cap (# shares outstanding x price per share). Therefore, the largest companies comprise the greater percentage of the index.

Currently, Microsoft comprises 4.31% of the index, followed closely by Apple (3.74%) and Amazon (3.06%). Together they comprise 11.11% of the index. What does this mean? If these stocks were to experience a severe decline, it would have a greater impact on the index than the bottom 100 companies, which combined comprise only 2.95% of the entire index.

Interest Rates

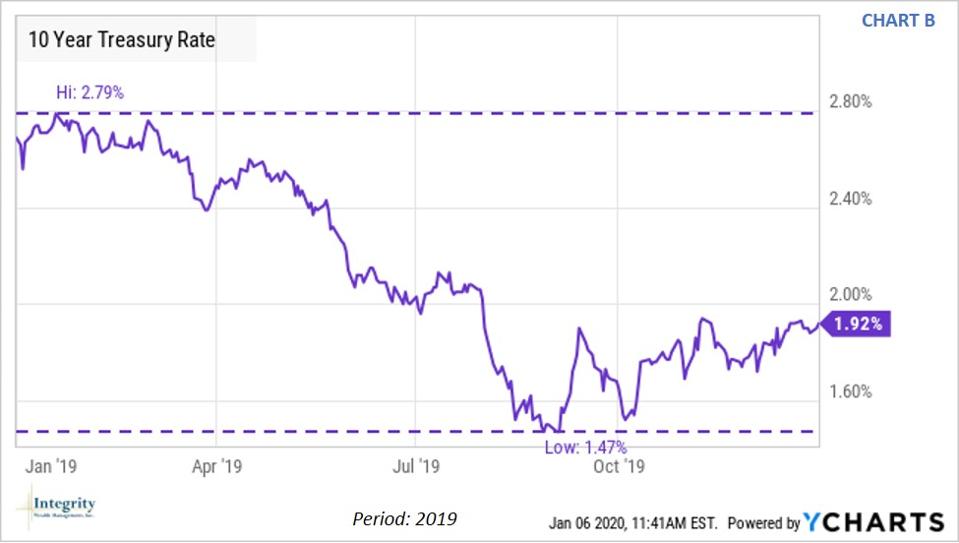

In the mid-1990s, Fed Chair Alan Greenspan remarked that the yield on the 10-year Treasury was the most revealing statistic on the health of the U.S. economy. One reason for this is that it is closely tied to mortgage rates and the housing market, which is a major component of the economy. The following chart (Chart B) shows how this rate changed during 2019. First, it peaked January 18 (2.79%), then bottomed August 28 and September 4 (1.47%), before ending the year at 1.92%.

2019 Year in Review-Chart B

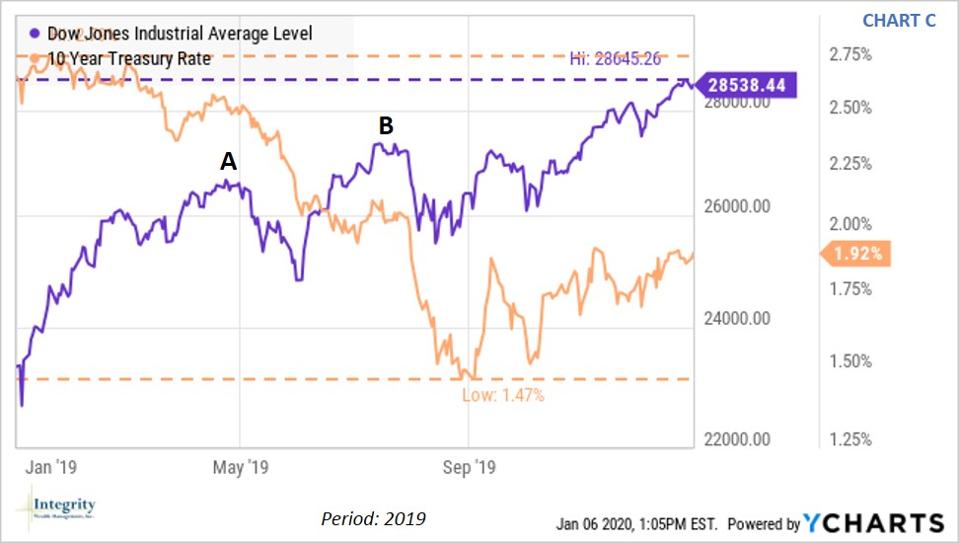

In general, a rising yield may indicate an improving economy. Conversely, when the yield falls, it could signal weaker economic growth. There are a few inferences we can make here. The following chart will help illustrate this (Chart C). First, when the 10-year yield fell (orange line), stock investors became concerned that the economy was slowing, which caused increased selling pressure, sending stock prices lower. Refer to points “A” and “B” to see how stocks declined (purple line) as yields fell. Recession fears and trade concerns were a significant catalyst.

2019 Year in Review-Chart C

Other Issues

It’s common, when trying to assess the economy and financial markets, to encounter a mixed bag of data. On the positive side, the U.S. economy continues to do very well. Moreover, with an election approaching, the incumbent party will do everything within their power to sustain the momentum.

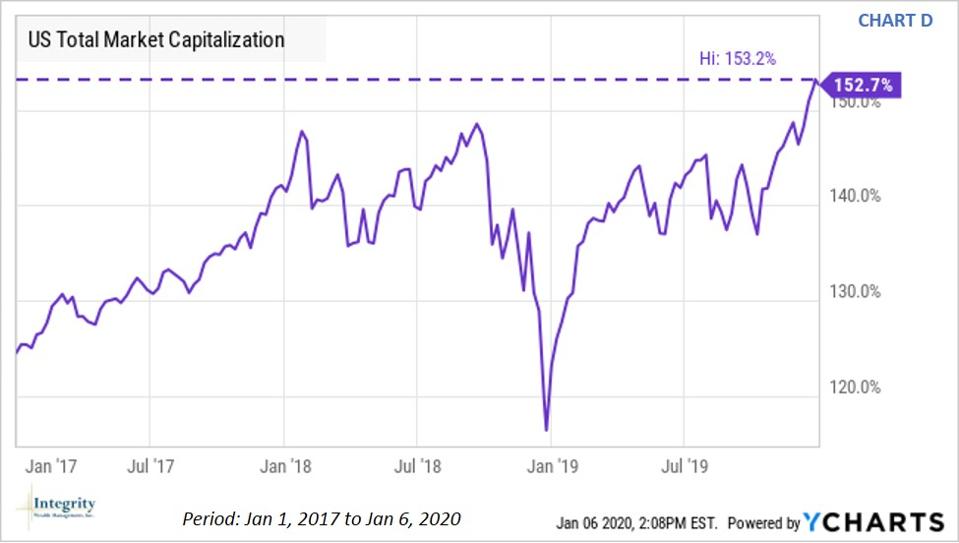

On the flip side, U.S. publicly traded stocks, in the aggregate, are overvalued. The following chart tells the story. Stocks were 49.4% overvalued on January 26, 2018 (i.e. a reading of 149.4%). This was the highest reading to date. Currently, the reading is 152.7% or 52.7% overvalued, which is an all-time high for this valuation tool (NOTE: 100% = fair value). It should be mentioned that there is no single indicator to guide us in this area.

2019 Year in Review-Chart D

The million-dollar question: What might we expect in 2020? Here are some issues to consider.

Trade Fears

This seems to have subsided…at least for now. Some believe there will not be a comprehensive trade deal with China. That’s rather hard to say. Regardless, the U.S. can find whatever it needs from other countries if necessary. If this holds true, some U.S. companies will have to alter their supply chain, which might cause a small disruption but nothing terribly significant in economic terms. Basically, China needs us more than we need them. This is because China has an export-based economy and as such, needs to sell its products to the world. Plus, the U.S. is China’s largest customer.

The U.S. Economy

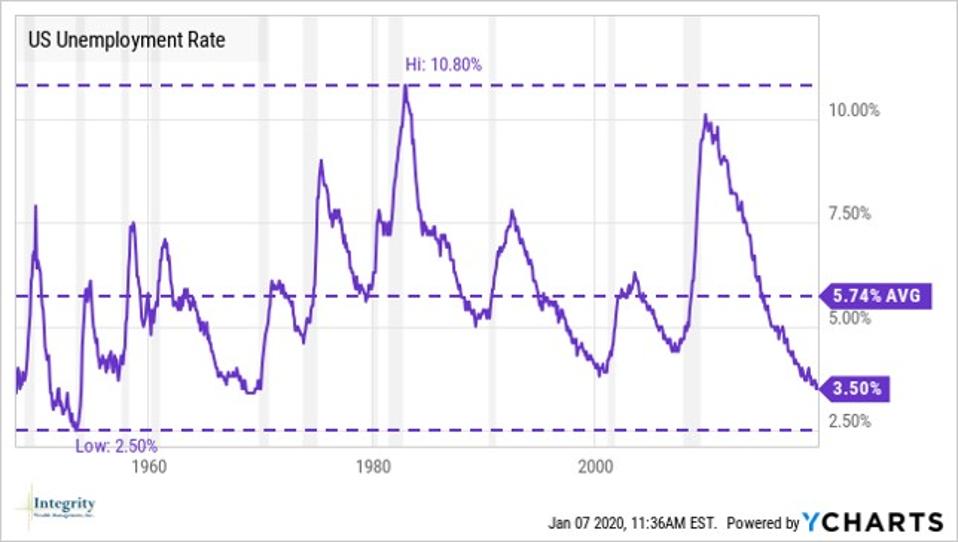

- Unemployment is 3.5%, which is near a historic low (see Chart E below)

- GDP grew at 1.9% in the third quarter of 2019 (slightly weaker, but acceptable)

- The annual rate of inflation in 2019 was 2.1% (near the Fed’s target rate of 2.0%)

- The housing market is strong as mortgage rates remain low

- The U.S. consumer continues to spend at a healthy rate

- The probability of a recession anytime soon is low

2019 Year in Review-Chart E

The November 2020 Election

On Tuesday, November 3, 2020, we will vote for president, all 435 seats in the U.S. House and 35 of the 100 seats in the U.S. Senate. President Trump needs to avoid a weak economy and falling stock market. Hence, the administration will do everything possible to avoid this.

While my concern over the higher level of stock prices has risen over the past few months, I do not believe we will see a significant downturn anytime soon. That said, things can change rather quickly so stay tuned.

2020-01-11 14:45:33Z

https://www.forbes.com/sites/mikepatton/2020/01/11/glancing-back-and-looking-ahead-stocks-and-the-us-economy-2019-2020/

CAIiEI6M_GKZ3rXq83So55MOzCkqFQgEKg0IACoGCAowrqkBMKBFMLKAAg

Bagikan Berita Ini

0 Response to "Glancing Back And Looking Ahead: Stocks And The U.S. Economy 2019-2020 - Forbes"

Post a Comment